TAXED

ENOUGH

ALREADY

WHY YOU SHOULD VOTE NO MARCH 5

JOIN WAGONER CITIZENS RALLY! – Wagoner – Saturday March 2 at Semore Park at noon.

Listen to coverage of our stand against these oppressive taxes:

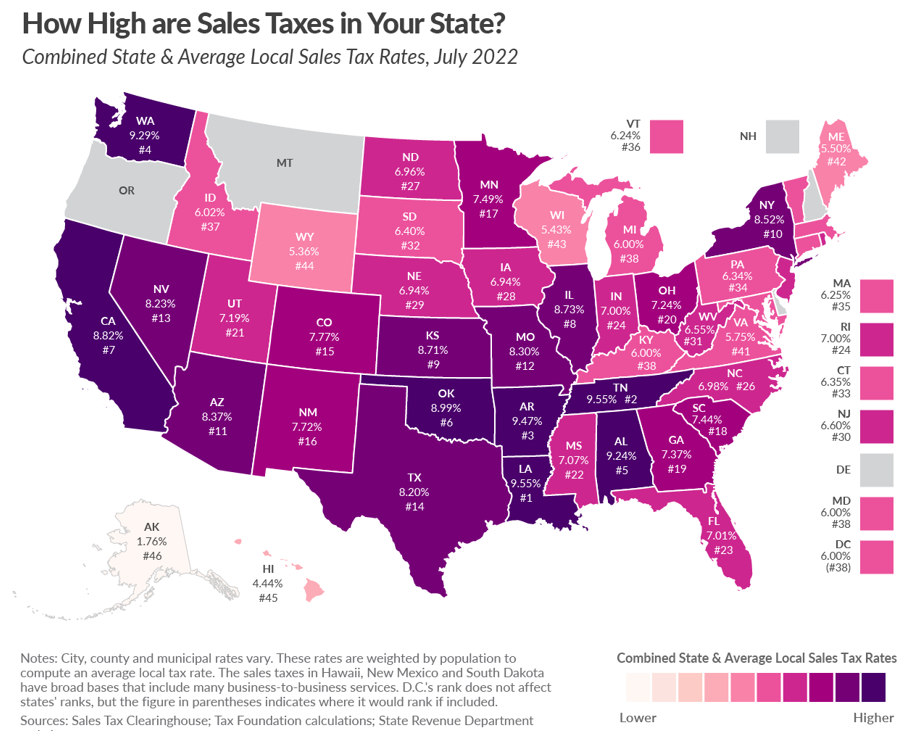

- EXTREME – We have one of the HIGHEST sales tax rates in the nation already, and this increase will place us in the top 1% of citizens paying the highest tax rates. If passed tax rates will be:

- Coweta – 10.3%

- Wagoner – 10.3%

- Broken Arrow – 9.85%

- EXPENSIVE – Will cost an average of $104/person –$416 for a family of 4. (Source: FY 2023 Oklahoma Revenue & Apportionment Report – total collections of state tax $3,798,881,293 divided by 4.5% = $884,195,843/1%; divided by population of 4,053,824 = $208/1% per person; 0.5% = $104/person annually).

- EXCESSIVE – This is 40% increase in sales tax collected by Wagoner County (.5%/1.3%). Funds freed by the jail trust proposed could be used to fund the other proposals, instead they just ask for more – Typical tax and spend!

- ECONOMY – Our local economy will be hurt as citizens shop in nearly Tulsa County to save as 1.9% on their purchases (Coweta 10.3% – Broken Arrow (Tulsa County) 8.4%)

- EGREGIOUSLY UNFAIR – This election was sprung on people with very little warning. The special election process makes it easy for special interests to push through tax increases while most voters have no idea that this is happening.

contact for more info: info@taxedenoughalready.com